Vol 22, N° 44, Julio-Diciembre 2024

ISSN: 1409-3251, EISSN: 2215-5325

Credit assess and welfare status of smallholder: evidence from farmers in Kwara state, Nigeria

Evaluación del crédito y estado del bienestar de los pequeños productores: evidencia de agricultores en el estado de Kwara, Nigeria

Avaliação do crédito e estado do bem-estar dos pequenos produtores: evidências de agricultores no estado de Kwara, Nigéria

Osasona Kehinde Kikelomo

University of Ilorin, Nigeria

https://orcid.org/0000-0001-5652-4514

Salami Mercy Funke

University of Ilorin, Nigeria

https://orcid.org/0000-0003-0236-0985

Rotimi Olamide Faith

University of Ilorin, Nigeria

https://orcid.org/0009-0004-6847-7670

Belewu Kafayat Yemisi

University of Ilorin, Nigeria

https://orcid.org/0000-0002-8474-5274

Bonire John Oluwaseun

Universidad de Ilorin, Nigeria

https://orcid.org/0009-0009-2229-7021

DOI: http://doi.org/10.15359/prne.22-44.1

Fecha de recepción: 06/11/2023  Fecha de aceptación: 17/06/2024

Fecha de aceptación: 17/06/2024  Fecha de publicación: 22/07/2024

Fecha de publicación: 22/07/2024

ABSTRACT

Lack of proper access to credit poses a major threat to agricultural production and food security globally, yet commercial bank, co-operative societies, microfinance banks, agricultural development programs, non- governmental organizations, government agricultural schemes offer loans to low-income individuals who have need of it despite the challenges encountered in accessing and managing it by farmers. However, there is limited research on the effectiveness of credit programs in improving the welfare of smallholder farmers in Kwara state, Nigeria. Therefore, the nexus between credit assess and welfare status of smallholder farmers in Kwara state, Nigeria was analyzed. Quantitative data was collected from 120 smallholder farmers selected through a three multi-stage sampling techniques. Data was analyzed using descriptive statistics, per capita expenditure, per capita income, and ordinary least square. Results showed that most respondents were middle-aged married males engaged primarily in farming, with moderate education, experience and income levels. It was also revealed that there is high awareness and use of credit. The major source of credit for the respondents was cooperative societies (60%) with least of agricultural development programs (3.92%). Overall, 58.93% of smallholder farmers had access to credit. Key perceived benefits were investment in agriculture (32.50%) and increased productivity (31.67%), and diversification of farming activities (20.83%). The significant factors influencing the welfare status of smallholder farmers include credit amount, age and household size. Based on these findings, it is recommended that both formal and informal sources of credit be established for farmers within the farmers’ vicinity.

Keywords: Income, Credit sources, Farmers, agricultural investments, Sustainability

RESUMEN

La falta de acceso adecuado al crédito representa una gran amenaza para la producción agrícola y la seguridad alimentaria a nivel mundial. Sin embargo, los bancos comerciales, las sociedades cooperativas, los bancos de microfinanzas, los programas de desarrollo agrícola, las organizaciones no gubernamentales y los esquemas agrícolas gubernamentales ofrecen préstamos a personas de bajos ingresos que los necesitan, a pesar de los desafíos que enfrentan los agricultores para acceder y gestionar estos créditos. No obstante, existe una investigación limitada sobre la efectividad de los programas de crédito en la mejora del bienestar de los pequeños agricultores en el estado de Kwara, Nigeria. Por lo tanto, se analizó el vínculo entre la evaluación del crédito y el estado de bienestar de los pequeños agricultores en el estado de Kwara, Nigeria. Se recopilaron datos cuantitativos de 120 pequeños agricultores seleccionados mediante una técnica de muestreo de tres etapas. Los datos se analizaron utilizando estadísticas descriptivas, gasto per cápita, ingreso per cápita y mínimos cuadrados ordinarios. Los resultados mostraron que la mayoría de los encuestados eran hombres casados de mediana edad dedicados principalmente a la agricultura, con niveles moderados de educación, experiencia e ingresos. También se reveló una alta conciencia y uso del crédito. La principal fuente de crédito para los encuestados fueron las sociedades cooperativas (60%), siendo los programas de desarrollo agrícola la fuente menos utilizada (3.92%). En general, el 58.93% de los pequeños agricultores tenía acceso a crédito. Los principales beneficios percibidos fueron la inversión en agricultura (32.50%), el aumento de la productividad (31.67%) y la diversificación de las actividades agrícolas (20.83%). Los factores significativos que influyen en el estado de bienestar de los pequeños agricultores incluyen el monto del crédito, la edad y el tamaño del hogar. Basado en estos hallazgos, se recomienda que se establezcan tanto fuentes formales como informales de crédito para los agricultores dentro de su proximidad.

Palabras clave: Ingreso, Fuentes de crédito, Agricultores, Inversiones agrícolas, Sostenibilidad

RESUMO

A falta de acesso adequado ao crédito representa uma grande ameaça à produção agrícola e à segurança alimentar globalmente. No entanto, bancos comerciais, sociedades cooperativas, bancos de microfinanças, programas de desenvolvimento agrícola, organizações não governamentais e esquemas agrícolas governamentais oferecem empréstimos a indivíduos de baixa renda que precisam deles, apesar dos desafios enfrentados pelos agricultores para acessar e gerenciar esses créditos. No entanto, há uma pesquisa limitada sobre a eficácia dos programas de crédito na melhoria do bem-estar dos pequenos agricultores no estado de Kwara, Nigéria. Portanto, foi analisada a relação entre a avaliação de crédito e o estado de bem-estar dos pequenos agricultores no estado de Kwara, Nigéria. Dados quantitativos foram coletados de 120 pequenos agricultores selecionados por meio de uma técnica de amostragem em três estágios. Os dados foram analisados usando estatísticas descritivas, despesa per capita, renda per capita e mínimos quadrados ordinários. Os resultados mostraram que a maioria dos entrevistados eram homens casados de meia-idade envolvidos principalmente na agricultura, com níveis moderados de educação, experiência e renda. Também foi revelada uma alta conscientização e uso de crédito. A principal fonte de crédito para os entrevistados foram as sociedades cooperativas (60%), sendo os programas de desenvolvimento agrícola a fonte menos utilizada (3.92%). No geral, 58.93% dos pequenos agricultores tinham acesso a crédito. Os principais benefícios percebidos foram investimento na agricultura (32.50%), aumento da produtividade (31.67%) e diversificação das atividades agrícolas (20.83%). Os fatores significativos que influenciam o estado de bem-estar dos pequenos agricultores incluem o valor do crédito, idade e tamanho do agregado familiar. Com base nesses achados, recomenda-se que sejam estabelecidas fontes formais e informais de crédito para os agricultores dentro de sua proximidade.

Palavras-chave: Renda, Fontes de crédito, Agricultores, Investimentos agrícolas, Sustentabilidade

Smallholder farmers are the backbone of agriculture in many developing countries, including Nigeria. Every agricultural technique depends on a few key elements to be successful. Having access to inputs like machinery, finance, fertilizer, herbicides, and seeds is crucial. Accessibility to credit is one of these elements that is essential to the process of reducing poverty (El-Komi, 2010). Agricultural producers in developing nations, especially those in low-income nations, encounter several challenges such as low productivity, restricted market accessibility for their goods, insufficient risk management products and services, and restricted financial availability. Even though it employs over 55% of the workforce in Africa, agriculture still contributes significantly to the continent’s economy; nonetheless, just 1% of bank loans are made to this sector. Furthermore, microcredit fills the gap between formal financial institutions and bank accounts by giving financial capital to people who would not otherwise be able to access credit. In developing countries, just 4.7% of adults in rural areas have a loan from a formal financial institution and only 5.9% have a bank account. (Dawuni, Mabe, & Tahidu, 2021)

According to Nwaru, Essien & Onuoha (2011), agricultural credit is the ability and willingness of the owner to temporarily lend someone their purchasing power, with the condition that the borrower be able and willing to repay the loan at a given time, with or without interest. Agricultural finance is given high priority in countries like Brazil and India where it is a temporary replacement for personal savings and speeds up technological advancements to boost agricultural production by improving the productivity, asset formation, and food security of smallholder farmers.

One effective way to combat poverty may be to improve the financial system. Enabling smallholders to effectively integrate into their countries’ economies, actively participate in their development, and safeguard themselves against economic shocks can be achieved through the provision of a robust financial system, thereby conferring economic and social empowerment upon individuals. (Waje, 2020) In many developing nations, smallholder farmers still face significant obstacles in getting access to agricultural loans. For one thing, most smallholder farmers don’t have the necessary collateral to be able to borrow from formal sources, therefore they frequently need tiny loans, which are hard to manage.

Smallholder farmers in Kwara State face numerous challenges, including limited access to credit facilities, which affects their ability to improve their farming operations and increase their income. Credit have emerged as a possible solution to this problem, loans through commercial bank, co-operative societies, microfinance banks, agricultural development programs, non- governmental organizations, government agricultural schemes are offered to low-income individuals. However, there is limited research on the effectiveness of credit programs in improving the welfare of smallholder farmers in Kwara state. Therefore, this research aims to assess the nexus between credit assess and welfare status of smallholder farmers in Kwara state, Nigeria. Specifically, we:

1.identify the socio economic characteristics of the smallholder farmer in the study area;

2.determine the sources of credit available to smallholder farmers in the study area;

3.determine the welfare status of smallholder farmers in the study area; and

4.examine the effect of credit on the welfare of smallholder farmers in the study area.

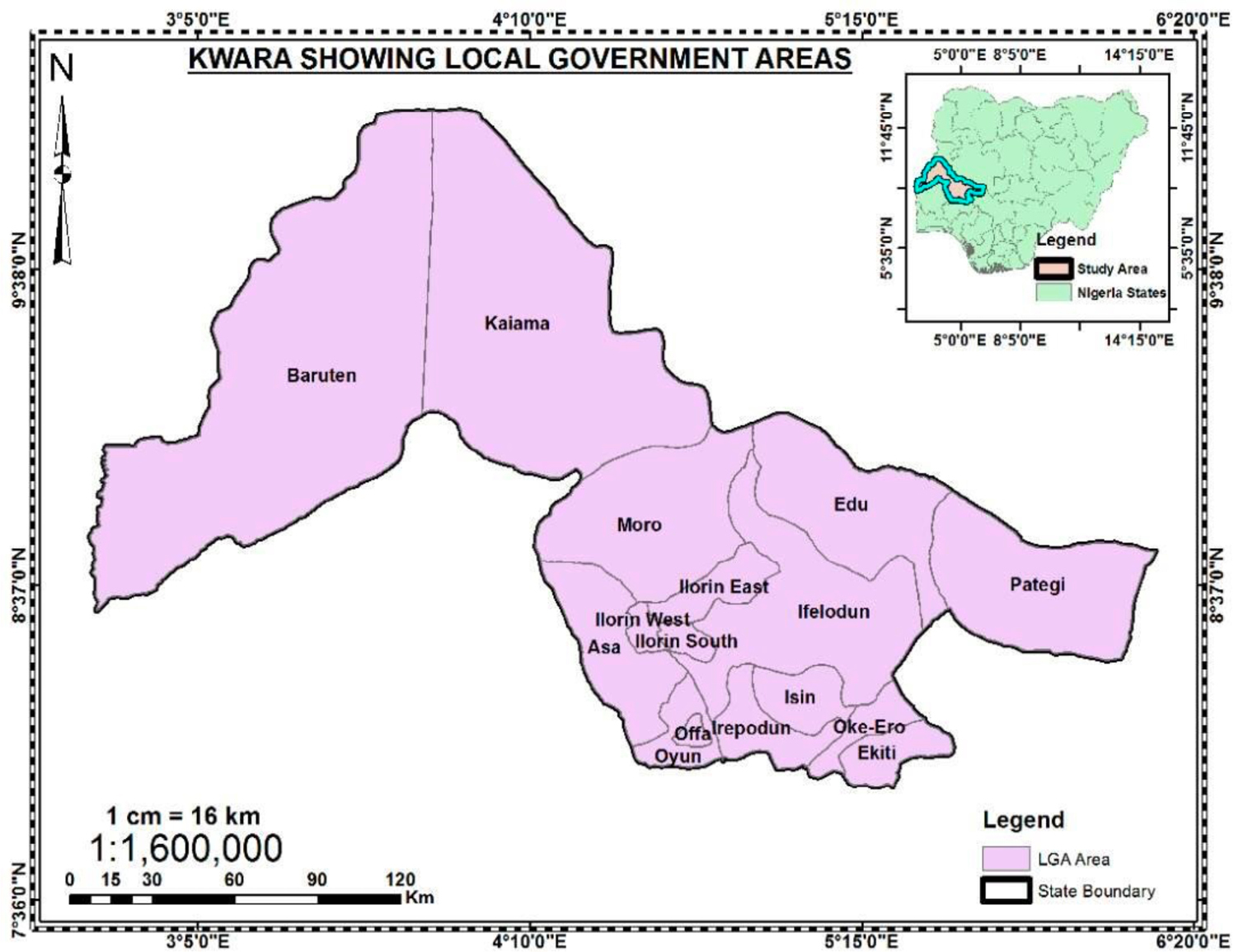

Kwara state was the study area. In May of 1967, the state was established by the federal government. Kwara State is situated between latitudes 8030’ and 8050’N and longitudes 4020’ and 4035’E on the Equator. Moreover, the state borders the republic of Benin on the west, Kogi State on the east, Oyo, Ekiti, and Osun State on the south, and Niger State on the north (KWSG Website). Based on the 2006 census, Kwara had a population of approximately 2,365,353. Given Nigeria’s 2.6% annual population growth rate, the state’s predicted population in 2022 should be 3,551,000. (NBS, 2017).

The dry season in Kwara State used to run from October to March, but climatic fluctuations have caused this to gradually push forward. The state receives between 1,100 and 1,500 mm of rainfall annually between March and early September (Oloyede, Muhammad-Lawal, Amolegbe, Olaghere & Joseph, 2021). Once more, this is likewise trending upward when the temperature stays high into April and May. In the wet season, the temperature is consistently high and ranges from 25 to 30 degrees Celsius; in the dry season, it is between 33 and 34 degrees Celsius. Generally, the state is home to subsistence farmers who grow only rain-fed cereals, legumes, and tubers.

Tree crops and a variety of other food crops can be grown in the state due to its rich soil, vegetation, and climate pattern. Millet, guinea-corn, rice, soy beans, cowpea, cassava, and yam are the main food crops planted. Its capacity to produce more than 200 metric tonnes of maize annually is a result of recent changes in Kwara state’s maize output (KWSG, 2019). In Kwara, farming—mainly the production of maize—occupies 75–80% of the population. Corn production is widely practiced, both commercial and smallholder.

Based on cultural customs, ecological traits, and project administrative ease, the Kwara State Agricultural Development Project (ADP) divides the state into four (4) agricultural zones.

Figure 1

Map of Kwara state showing the different Local government areas.

Note: Adapted from Omotesho et al., 2019

A three-stage sampling technique was used, which involved two local government areas being randomly selected from the ADP zones C and D. Then three (3) farming villages were then selected from each of the randomly local government area.10 farmers were then randomly selected from each farming village selected making 120 respondents.

Descriptive statistics

It was used to identify the socioeconomics characteristics of smallholder farmers and to determine the sources of credit available to farmers.

Per capita expenditure and per capita income

Per capita expenditure is often used as a measure of individual welfare because it provides an indication of how much an individual or household is able to spend on goods and services. Per capita expenditure is calculated by dividing the total expenditure by the number of people in the population. Per capita income is the average amount of money earned over a particular period of time, generally a year, by each individual in a given population. It is computed by taking the population’s entire size and dividing it by the total income produced within it.

Ordinary Least Square Regression(OLS)

The ordinary least square regression was used to analyze the relationship between credit assessed and welfare of smallholder farmers in Kwara state.

Y=B0+B1X1 +B2X2 +B3X3 +B4X4 +B5X5 + d1+d2+e

Therefore, the regression analysis is as follows:

Y =f(X1,X2,X3,X4,X5,d1,d2,e,)

Dependent variable(Y)= welfare index

The independent variables(X1…..Xn) are:

X1= Frequency of credit gotten (annually =1, quarterly=2 and monthly =3)

X2= Farm size (hectares)

X3= Age (years)

X4= household size(numbers)

X5= amount of credit gotten (₦)

d1= Marital status (Single=1, Married=2)

d2 = Sex of farmer (Male =1, Female=2)

e= error term

b0=constants term

B1……..B5= Coefficients

Socio-economic characteristics of the respondents

Table 1 shows the socio-economic profile of the respondents. The sample of farmers obtained during the research reveals that 82.50% of the respondents were males while 17.50% were females. It indicates that the level of participation in agriculture skews towards the male respondents. This is not surprising as males dominate most agricultural activities in Nigeria (Ileka et al., 2020).

Results below also revealed that 25% of the respondents were within the ages of 41-50, 24.17%, 20.00%,18.33% and 12.50% were within the ages of 31-40,51-60, above 60 years and less than 30 respectively, and standard deviation of 14.70. This suggests that the typical maize farmer was still in his economically active age and has access to family labor, which forms a significant part of farm labor (Idrisa et al. 2012; Adegboye 2016).

The findings show the respondents’ marital status. When it came to their seriousness and emotional stability in the agricultural production process, the majority of farmers were married (79.17%), compared to 16.67% who were single and 4.17% who were separated. The results of Adeniyi & Ogunsola (2014) and Simonyan, et al. (2011), who indicated that one of the key features of Nigerian farmers was their marital status, are consistent with this outcome. This finding is also consistent with the findings of Girei, et al. (2018), who suggested that married farmers are probably dedicated to raising farm yields because it is essential to their family’s survival.

As shown in table 1 below, majority of the respondents were knowledgeable having one form of education or the other, with 40% and 30% being secondary and primary education,12.50% and 17.50% being tertiary and non-formal education respectively. This implies that respondents’ literacy level was high and likely to improve their knowledge agricultural practices. This result is consistent with the research conducted by Ojo, et al. (2009) and Etim et al. (2013), which revealed that education has a major impact on farm decisions in Nigeria.

Majority of the respondents engage in farming as their primary occupation (60%), while 40% have other non-farming occupations ranging from Artisans, Traders, Teachers, Clergymen and Civil Servants. This implies that the respondents are dedicated to farming as an occupation.

Result on household size shows that about 51.67% had a household size of less than 6 persons, 41.67 had about 6 to 10 persons while 6.67% had less than or equal to 10 person. The result also showed the average of 6 persons in a household with a standard deviation of 2.68. Household size can influence the household expenditure on food, clothing and shelter, by making more hands available for productive activities on the farm. According to the NBS (2017) study, the average household size of Nigerians living in North Central region is less than ten people. This finding is consistent with that report.

The result on annual income showed that about 28% of the respondents earned less than ₦300,000 annually, 43.33% earned ₦300,001 to ₦600,000, 26.67% earned between ₦600,001 to ₦900,000 while 6.67% earned above ₦900,000 annually. Annual income can be determined by occupation, experience, level of education, etc. The average annual income from small scale farming was found to be ₦656,453.78. The income level suggests maize farming provides a moderate livelihood for the respondents. This is in compliance with Ojiem, et al. (2014) which showed that maize farming households they surveyed in agro-ecological zones of Nigeria had mean annual incomes of ₦319,270–₦491,250 falling under the national poverty line.

It was also revealed that 69.17% of the respondents had no access to extension services, 30.83% had access. According to Adetunji (2013), the government’s refusal to accede to the farmers’ main demand is the reason why extension contact in Nigeria is progressively decreasing.

Farmers can increase their level of productivity on their farms by gaining experience in any type of agricultural enterprise. Experienced smallholder farmers will know how to optimize farm outputs by combining agricultural inputs in the best possible way. The findings revealed that, among the respondents, 45.83% had more than 15 years of experience, while 24.17%, 15.83%, and 14.17% had 6–10, less than 5 and 11–15 years of experience, respectively.

The average farm size of the respondents was 1.89 hectares, with 98.33% having less than 5 ha and 1.67% having more than 5 ha. This agrees with the estimations of Mgbenka et al. (2015), who stated that in 1999, farm sizes ranging from 0.4 to 1.01 hectares were classified as small scale farms, and 1.01 to 3.03 hectares as medium sized farms, according to information provided by the Federal Office of Statistics. The results also revealed that over 73.33% of people were engaged in farming, whereas 23.33% and 3.33% of people were involved in raising livestock and fishing, respectively.

Table 1

The socio-economic characteristics of the respondents

|

Variables |

Frequency (120) |

Percentage (%) |

Mean(SD) |

|

Sex |

|||

|

Male |

99 |

82.50 |

|

|

Female |

21 |

17.50 |

|

|

Age (years) |

|||

|

≤ 30 |

15 |

12.50 |

|

|

31 – 40 |

29 |

24.17 |

|

|

41 – 50 |

30 |

25.00 |

|

|

50 – 60 < 60 |

24 22 |

20.00 18.33 |

47(14.70) |

|

Marital Status |

|||

|

Single |

20 |

16.67 |

|

|

Married Separated |

95 5 |

79.17 4.17 |

|

|

Level of education |

|||

|

No formal education |

21 |

17.50 |

|

|

Primary education |

36 |

30.00 |

|

|

Secondary education |

48 |

40.00 |

|

|

Tertiary education |

15 |

12.50 |

|

|

Primary Occupation |

|||

|

Farming |

72 |

60.00 |

|

|

Teacher Trader Artisan Civil servant Clergy |

3 14 26 4 1 |

2.50 11.67 21.66 3.23 0.83 |

|

|

Household size (persons) |

|||

|

≤ 5 |

62 |

51.67 |

|

|

6 – 10 |

50 |

41.67 |

|

|

Above 10 |

8 |

6.67 |

6(2.68) |

|

Annual income (₦) |

|||

|

≤ 300,000 |

28 |

28 |

|

|

300,001 – 600,000 |

52 |

43.33 |

|

|

600,001 – 900,000 |

32 |

26.67 |

|

|

Above 900,000 |

8 |

6.67 |

656,453.78(701,980.42) |

|

Access to extension services |

|||

|

Yes |

37 |

30.83 |

|

|

No |

83 |

69.17 |

|

|

Type of farming involved in |

|||

|

Livestock |

35 |

23.33 |

|

|

Cropping |

110 |

73.33 |

|

|

Fishing |

5 |

3.33 |

|

|

Farming experience |

|||

|

≤ 5 |

19 |

15.83 |

|

|

6 –10 |

29 |

24.17 |

|

|

11 – 15 |

17 |

14.17 |

|

|

Above 15 |

55 |

45.83 |

17.75(11.68) |

|

Farm size (ha) |

|||

|

≤ 5 |

118 |

98.33 |

|

|

Above 5 |

2 |

1.67 |

|

|

Membership of an organization |

|||

|

Yes |

38 |

31.67 |

|

|

No |

82 |

68.33 |

|

|

Benefits derived from organization |

|||

|

Credit facilities |

31 |

25.83 |

|

|

Purchase of inputs |

22 |

18.33 |

|

|

Forward contract |

3 |

2.50 |

|

|

Storage facility |

1 |

0.83 |

|

|

Cooperation |

1 |

0.83 |

Note: Field Survey, 2023

Sources of credit available to smallholder farmers

The analysis of respondents’ credit usage patterns provides a thorough picture of their financial habits and the significance of credit in their lives. The major source of credit for the respondents was cooperative societies (60%), followed by microfinance banks (20%). Very few accessed credit from commercial banks (9.17%), NGOs (0.83%), government schemes (0.83%) and agricultural development programs (3.92%). This implies that formal credit institutions like commercial banks are not the major sources of credit for smallholder farmers. They rely more on sources like cooperatives and microfinance banks and this opposes the findings of Ullah et al.,2020.

The result that 58.93% of respondents had taken out loans in the previous six months is particularly significant since it shows that there is a high demand for credit. This may indicate that people are becoming more aware of the crucial function credit plays in supporting economic activity. It also draws attention to the probable exclusion of the other 41.07% of the population who do not use credit. Targeted financial literacy programs and initiatives to make credit more accessible to minority groups could be used to address this difference.

For those who accessed credit, the majority (52.5%) accessed less than 100,000 naira. Only 6.67% accessed above 500,000 naira. This implies that smallholder farmers tend to access credit in small amounts, likely due to their small scale of operations. This suggests a reliance on microcredit for small scale activities, primarily in the agriculture sector which is in line with Robert et al (2021) who believed that microcredit loans have been as a driving means to help smallholder farmers. A more significant investment in farming or other businesses that generate revenue may be suggested by the result that 15% of people have access to loans beyond 400,000 naira. This variation emphasizes how flexible lending is to different financial demands.

The community’s strong ties to agriculture are reflected in the use of credit for farming (38.33%), although usage of credit for personal (11.67%) and non-farm uses (8.33%) implies that while credit is useful for financing farming operations, some smallholder farmers also divert it for non-farm needs. The opportunity to increase financial inclusion and expand the use of credit for income diversification is revealed by the fact that 41.67 percent of people do not have access to credit.

Majority (62.86%) who accessed credit did so on an annual basis. 35.71% accessed quarterly and 1.43% accessed monthly credit. This shows that credit is obtained mostly for seasonal farming activities rather than for regular farm operations. This periodic usage aligns with agricultural cycles, indicating credit’s assistance with seasonal operations like planting and harvesting.

The perceived benefits of accessing credit were investment in agriculture (32.50%) and increased productivity (31.67%), and diversification of farming activities (20.83%). This shows that access to credit facilitates increased farm production and investment for smallholder farmers which agrees with Sakhno et al., (2019). However, very few (3.33%) indicated access to markets as a benefit; implying credit may not directly link them to markets. The lower percentages suggesting improved access to market possibilities (3.33%) and food security (9.17%) highlights areas that could be improved, perhaps through targeted initiatives that link credit to these desired results.

Table 2

Respondents’ access to credit

|

Variables |

Frequency |

Percentage |

Mean(SD) |

|

Sources of credit available to the respondents |

|||

|

Commercial bank |

11 |

9.17 |

|

|

Non-governmental organizations |

1 |

0.83 |

|

|

Government agricultural schemes |

1 |

0.83 |

|

|

Co-operative societies |

72 |

60.00 |

|

|

Microfinance banks |

24 |

20.00 |

|

|

Agricultural development programs |

4 |

3.92 |

|

|

Have you received any form of credit in the last 6 months? |

|||

|

Yes |

70 |

58.93 |

|

|

No |

50 |

41.07 |

|

|

Amount of credit you had access to |

|||

|

<100000 |

63 |

52.5 |

|

|

100001-200000 |

15 |

12.5 |

|

|

200001-300000 |

12 |

10 |

|

|

300001-400000 |

4 |

3.3 |

|

|

400001-500000 |

18 |

15 |

|

|

>500000 |

8 |

6.67 |

3863.64(692435.62) |

|

Use for the credit obtained |

|||

|

Farming purpose |

46 |

38.33 |

|

|

Off farm purposes |

10 |

8.33 |

|

|

Personal use |

14 |

11.67 |

|

|

I do not obtain credit |

50 |

41.67 |

|

|

Frequency of credit need |

|||

|

Annually |

44 |

62.86 |

|

|

Monthly |

1 |

1.43 |

|

|

Quarterly |

25 |

35.71 |

|

|

Perceived effect of the access to credit |

|||

|

Increased productivity |

38 |

31.67 |

|

|

Diversification of farming activities |

25 |

20.83 |

|

|

Increased investment in farming |

39 |

32.50 |

|

|

Enhanced food security |

11 |

9.17 |

|

|

Access to market opportunities |

4 |

3.33 |

|

|

Risk mitigation |

15 |

12.50 |

Note: Field Survey, 2023

Welfare Status of Smallholder Farmers

Table 3 presents the welfare status of the smallholder farmers based on their monthly household income and expenditure. The average monthly household expenditure on food was ₦69,402.5, while the monthly per capita expenditure on food was ₦14,145.79 ($18.03). This shows that on average, each household member spent about ₦14,000 ($17.84) monthly on just food.

For non-food items, the average monthly household expenditure was ₦52,325.53 ($66.68), while the per capita monthly expenditure was ₦11,287.91 ($14.38). Added together, the total monthly household expenditure was ₦121,728.03 ($155.12), while the per capita monthly expenditure was ₦25,433.69 ($32.41). This implies that on average, each household member spent about ₦25,000 ($31.86) monthly on their needs.

On the income side, the average monthly household income was ₦566,025 ($721.29), while the monthly per capita income was ₦131,145.47($167.12). This indicates that on average, each member of the household earned about ₦131,000 ($166.93) monthly.

Comparing income and expenditure, the results show that the households had a welfare status (measured as income less expenditure) of ₦687, 775.03 ($876.44) monthly, while the per capita welfare was ₦156,579.16 ($199.53). This positive welfare status indicates that the households earned more than they spent on the average.

However, the expenditure breakdown shows that food took a significant portion of household spending (about 57% of total expenditure). This implies that meeting basic needs like food still makes up a major part of smallholder expenditures, which complies with the findings of Carranza & Niles (2019), who found out that smallholder farmers spend credit and income mainly on food.

The per capita expenditure being almost half of the per capita income also indicates that households spend a substantial portion of their earnings on routine upkeep. Therefore, while smallholder farmers appear to earn reasonably well, much of their income goes towards necessities, leaving less for profitability enhancing investments.

Overall, the results show that smallholder farmers have a reasonably positive welfare status. However, high spending on food highlights the need for increased productivity and income to improve profitability, savings and investment.

Table 3

Welfare status of smallholder farmers

|

Welfare Indices |

Amount (Naira) |

|

Monthly Food Expenditure |

69,402.5 |

|

Monthly per capita Food Expenditure |

14,145.79 |

|

Monthly non-Food Expenditure |

52,325.53 |

|

Monthly per capita non-Food Expenditure |

11,287.91 |

|

Monthly Expenditure |

121,728.03 |

|

Monthly per capita Expenditure |

25,433.69 |

|

Monthly Income |

566,025 |

|

Monthly per capita Income |

131,145.47 |

|

Welfare |

687,775.03 |

|

Per capita Welfare |

156,579.16 |

Note: Field Survey, 2023

Relationship between credit assessed and welfare of smallholder farmers in kwara state.

From table 4, the data set consists of 120 observations. The likelihood linked to the F-statistic is 0.0000, indicating a lower degree of significance than the standard 0.05. In favor of the null hypothesis that there is no association, this offers compelling evidence. With an R-squared of 0.60, the model’s independent variables are thought to be responsible for roughly 60.31% of the variation in the dependent variable.

The coefficient for credit is 0.013. The associated p-value is 0.024, which indicates a statistically significant relationship between credit amount and the welfare of smallholder farmers. An increase in credit amount is associated with a positive change in farmer welfare.

The coefficient for age in years is -2543.588, and the associated p-value is 0.003 (p < 0.01). This suggests a significant relationship between the age of smallholder farmers and their welfare. A negative coefficient implies that older farmers might have lower welfare levels which agrees with Ayenew, Lakew & Kristos, (2020).

The coefficient for household size is -26047.91, and the p-value is extremely low (p < 0.001). This indicates a strong and statistically significant negative relationship between household size and farmer welfare. Larger household sizes are associated with lower levels of welfare, which complies with Ehiakpor, Danso-Abbeam, Dagunga & Ayambila (2019) but opposes Lakhan et al. (2020), who believed that an increase in household size cause an increase in the provision of manual labour, which reduces the need for, hired labour.

The coefficient for this frequency of credit requirement is -18666.43. However, the p-value associated with this coefficient is 0.439, which is not statistically significant at common significance levels (such as 0.05 or 0.01). This suggests that there might not be a significant relationship between the frequency of credit requirement and the welfare of smallholder farmers.

The coefficient for farm size is 5010.914, and the p-value is 0.776. The high p-value suggests that there is no strong evidence to conclude that farm size significantly affects farmer welfare.

The constant term (453949.5) is statistically significant (p-value = 0.000), suggesting that there are other factors not included in the model that also affect the welfare of small-scale farmers.

Overall, the analysis suggests that credit amount, age, and household size have significant effects on the welfare of small-scale farmers, while frequency of credit requirement, farm size, and credit usage do not have significant effects.

Table 4

Relationship between Credit Assessed and Welfare of Smallholder Farmers in Kwara State.

|

Prob F = 0.0000 R-squared = 0.6031 Adj R-squared = 0.5512 Root MSE = 99733 |

||||

|

Variables |

Coeff |

Std. Err |

T |

P>|t| |

|

Frequency of credit requirement |

-18666.43 |

23976.22 |

-0.78 |

0.439 |

|

Credit Amount |

.01 |

.02 |

0.80** |

0.024 |

|

Farm size (Ha) |

5010.91 |

17581.50 |

0.29 |

0.776 |

|

Age in years |

-2543.59 |

830.58 |

-3.06*** |

0.003 |

|

Household size |

-26047.91 |

5326.66 |

-4.89*** |

0.000 |

|

Credit usage |

-4356.90 |

11171.85 |

-0.39 |

0.698 |

|

Constant |

453949.50 |

62014.57 |

7.32 |

0.000 |

***Significant at the 0.1 level;

** at the 0.05 level

Note: Field Survey 2023

The socioeconomic profile analysis shed light on the complex dynamics surrounding smallholder farmers. Despite their extensive experience in agriculture, they face significant hurdles in accessing extension services. Extension services are crucial for disseminating updated agricultural knowledge, technologies, and practices, which can directly impact farm productivity and sustainability. Limited access to these services may hinder farmers’ ability to adopt modern techniques, leading to stagnation or inefficiency in their agricultural operations.

The research also uncovered a notable challenge faced by smallholder farmers in accessing formal credit. Formal credit institutions such as banks often impose stringent requirements and collateral demands, making it difficult for small-scale farmers, who may lack assets or formal documentation, to qualify for loans. As a result, farmers often turn to informal sources, such as moneylenders or community-based lending groups, which may charge exorbitant interest rates and offer less favorable terms.

Despite earning relatively high incomes from agricultural activities, smallholder farmers grapple with substantial expenditures, particularly on food. This phenomenon underscores the prevalence of food insecurity among farming households, where a significant portion of income is allocated towards meeting basic dietary needs. High spending on food not only reflects the persistent challenge of food affordability but also raises questions about the adequacy of income and the need for interventions to enhance food access and affordability for farming communities.

The study further highlighted the significant influence of credit accessibility and other socioeconomic factors on the welfare outcomes of smallholder farmers. While informal credit sources partially fulfill farmers’ financial needs, a substantial portion of farmers still lack access to credit, indicating a persistent gap in financial inclusion. The research identified a strong positive correlation between credit access and welfare outcomes among smallholder farmers. Farmers reported utilizing credit primarily for agricultural investments, such as purchasing seeds, fertilizers, and equipment, as well as for expanding their farming operations. This injection of capital into agricultural activities contributed to increased productivity, diversified income streams, and improved overall welfare for farmers and their families. Moreover, access to credit facilitated risk mitigation strategies and resilience-building efforts, enabling farmers to navigate uncertainties associated with weather variability, market fluctuations, and other external shocks.

In summary, the research underscores the multifaceted nature of the challenges faced by smallholder farmers and the pivotal role of credit accessibility in unlocking their potential for sustainable agricultural development and improved livelihoods. Addressing barriers to credit access, enhancing extension services, and promoting holistic approaches to agricultural development are essential steps towards fostering inclusive growth and resilience in rural communities.

In line with the findings of this study, the following recommendations are made for improvement of welfare of smallholder farmers in Kwara State in Nigeria In line with the findings of this study, the following recommendations are made for improvement of welfare of smallholder farmers in Kwara State in Nigeria.

Government support and assistance to the farmer is also important. Associations can be established to help cater to the needs of the farmers in the study area.

Government and stake holders can formulate policies and implement strategies that will ensure increase in access to credit in the sub sector. Programs should be designed to train and inform farmers on the advantages of obtaining credit, this will serve as a means to encourage farmers to engage in their various farming organizations and obtain credit.

Adegboye, M. (2016) Socio-economic status categories of rural dwellers in Northern Nigeria. Advances in Research, 7(2), 1–10. https://doi.org/10.9734/AIR/2016/21836

Adeniyi, O., Ogunsola, G. (2014). Cocoa production and related social-economic and climate factors: A case study of Ayedire Local Government Area of Osun State, Nigeria. Russian Journal of Agricultural Sciences. 2014. 2(4): 161-187. https://www.researchgate.net/publication/280766588_Cocoa_Production_and_Related_Social-Economic_and_Climate_Factors_A_Case_Study_of_Ayedire_Local_Government_Area_of_Osun_State_Nigeria

Adetunji, M. (2013). Assessment of the quality of urban transport services in Nigeria. Academic Journal of Interdisciplinary Studies, 2 (1): 49 – 58. https://www.richtmann.org/journal/index.php/ajis/article/view/61

Ayenew, W., Lakew, T., Kristos, E. (2020). Agricultural technology adoption and its impact on smallholder farmers welfare in Ethiopia. African Journal of Agricultural Research, 15(3): 431–445. https://doi.org/10.5897/ajar2019.14302

Carranza, M., & Niles, M. T. (2019). Smallholder farmers spend credit primarily on food: gender differences and food security implications in a changing climate. Frontiers in Sustainable Food Systems, 3. https://doi.org/10.3389/fsufs.2019.00056

Dawuni, P., Mabe, F., Tahidu, O. (2021). Effects of village savings and loan association on agricultural value productivity in Northern Region of Ghana. Agricultural Finance Review, 81(5): 657-674. https://www.emerald.com/insight/content/doi/10.1108/AFR-02-2020-0024/full/html

Ehiakpor, D., Danso-Abbeam, G, Dagunga, G., Nsobire, S. (2019). Impact of Zai Technology on Farmers’ Welfare: Evidence From Northern Ghana. Technology in Society 59 – 101189: 1-8. https://doi.org/10.1016/j.techsoc.2019.101189

El-Komi, M. (2010). Poverty: Alleviation through microfinance and implications on education. [Doctoral Thesis] The University of Texas at Dallas.

Etim, N., Thompson, D., Onyenweaku, C. (2013). Measuring efficiency of yam (Dioscoreaspp.) produciton among resource poor farmers in rural Nigeria. Journal of Agriculture and Food Sciences. 1(3): 42-47. https://www.cabidigitallibrary.org/doi/pdf/10.5555/20143025675

Girei, A., Saingbe, N., Ohen, S., Umar, K. (2018). Economics of small-scale maize production in Toto local government area, Nasarawa state, Nigeria. Agrosearch 18 (1), 90–104. https://doi.org/10.4314/agrosh.v18i1.8

Idrisa Y., Ogunbameru B., Shehu H. (2012) Effects of adoption of improved maize seed on household food security in Gwoza Local Government Area of Borno state, Nigeria. Global Journal of Science Frontier Research Agriculture & Biology 128(5): 7-12. https://globaljournals.org/GJSFR_Volume12/2-Effects-of-Adoption-of-Improved-Maize-Seed.pdf

Ileka, C., Agumagu, A., Ifeanyi-Obi, C. (2020). Development needs of rice farmers in Anambra state, International Journal of Agricultural Economics, Management and Development, 8(1): 146-163. https://daeeksu.com/wp-content/uploads/2021/04/Ileka-et-al..pdf

Ministry of Agriculture and Rural Development KWSG (2019). Kwara State Agricultural Policy. https://kwarastate.gov.ng/ministry/ministry-of-agriculture-natural-resources/#department

Lakhan, G., Channa, S., Magsi, H., Koondher, M., Wang, J., Channa, N. (2020). Credit constraints and rural farmers’ welfare in an agrarian economy. Heliyon, 6(10), October, e05252. https://doi.org/10.1016/j.heliyon.2020.e05252

Mgbenka, R., Mbah, E., Ezeano, C. (2015). A review of smallholder farming in Nigeria: Need for transformation. International Journal of Agricultural Extension and Rural Development Studies, 3(2), 43-54. https://eajournals.org/ijaerds/vol-3-issue-2-may-2016/

National Bureau of Statistics. (2017). Demographic Statistics Bulletin. Federal Republic of Nigeria. https://nigerianstat.gov.ng/elibrary/read/775

Nwaru, J., Essien, U., Onuoha, R. (2011). Determinants of informal credit demand and supply among food crop farmers in Akwa Ibom State, Nigeria. Journal of Rural and Community Development, 6(1). https://journals.brandonu.ca/jrcd/article/view/618

Ojiem, J., Franke, A., Vanlauwe, B., De Ridder, N., Giller, K. (2014). Benefits of legume–maize rotations: Assessing the impact of diversity on the productivity of smallholders in Western Kenya. Field Crops Research, 168, 75-85. https://doi.org/10.1016/j.fcr.2014.08.004

Ojo, M., Mohammed, U., Ojo, A., Yisa, E., Tsado, J. (2009). Profit efficiency of small scale cowpea farmers in Niger State, Nigeria. International Journal of Agricultural Economics and Rural Development. 2(2), 40- 48 https://www.researchgate.net/publication/353269936_Profit_efficiency_of_small_scale_cowpea_farmers_in_Niger_state_Nigeria

Oloyede, W., Muhammad-Lawal, A., Amolegbe, K., Olaghere, I., Joseph, I. (2021). Comparative analysis of the profitability of rice production systems in Kwara State., Nigeria. Agrosearch, 20(2), 82-101. https://doi.org/10.4314/agrosh.v20i2.7

Omotesho, K., Akinrinde, F., Adenike, A., Awoyemi, A. (2019). Analysis of the use of information communication technologies in fish farming in Kwara State, Nigeria. Journal of Agribusiness and Rural Development, 54(4), 327-334. https://doi.org/10.17306/J.JARD.2019.01223

Robert, F., Frey, L., Sisodia, G. (2021). Village development framework through self-help-group entrepreneurship, microcredit, and anchor customers in solar microgrids for cooperative sustainable rural societies. Journal of Rural Studies, 88, 432–440. https://doi.org/10.1016/j.jrurstud.2021.07.013

Sakhno, A., Polishchuk, N., Salkova, I., Kucher, А. (2019). Impact of credit and investment resources on the productivity of agricultural sector. European Journal of Sustainable Development, 8(2), 335-345. https://doi.org/10.14207/ejsd.2019.v8n2p335

Simonyan, J., Umoren, B., Okoye, B. (2011). Gender differentials in technical efficiency among maize farmers in Essien Udim Local Government Area, Nigeria. International Journal of Economics and Management Sciences, 1(2): 17-23. https://www.hilarispublisher.com/open-access/gender-differentials-in-technical-efficiency-among-maize-farmers-in-essien-udim-local-government-area-nigeria-2162-6359-1-012.pdf

Ullah, A., Mahmood, N., Zeb, A., Kächele, H. (2020). Factors determining farmers’ access to and sources of credit: evidence from the rain-fed zone of Pakistan. Agriculture, 10(12), 586. https://doi.org/10.3390/agriculture10120586

Waje, S. (2020). Determinants of access to formal credit in rural areas of Ethiopia: Case study of smallholder households in Boloso Bombbe district, Wolaita zone, Ethiopia. Economics, 9(2), 40-48. https://www.sciencepublishinggroup.com/article/10.11648/j.eco.20200902.13

Escuela de Ciencias Agrarias,

Universidad Nacional, Campus Omar Dengo

Apartado postal: 86-3000. Heredia, Costa Rica

Teléfono: (506) 2277-3569

Correo electrónico: ruralrev@una.cr

Equipo editorial